Reduce Banking Costs

Services include:

- Loan interest rate monitoring

- Complimentary, periodic reviews of your monthly statements to highlight savings such as merchant services discount rates

- Loan application assistance, including coordinating lending requests with multiple banks while ensuring you obtain the lowest available borrowing costs

- Bank ratio monitoring: view a sample bank ratio report here [insert banking ratio sample report]

- Preparation of GAAP formatted financial statements to present your assets and equity to lenders in the best possible light

Loan Application Assistance

To obtain the lowest rates possible on your loans and lines, you need to obtain competitive offers from multiple banks and the unique knowledge of our professionals. Linked Accounting is well positioned to assume the time-consuming task of coordinating lending requests with multiple banks while ensuring you obtain the lowest available borrowing costs.

Bank Ratio Monitoring

Commercial lending and insurance bonds rely on hundreds of ratios calculated from your financial statements to establish a bank risk rating, or business credit score. Don’t want until you need a loan or bond to determine if your financial ratios allow you to qualify. Our experienced banking professionals can monitor your financial ratios and coach you towards improved banking capacity.

Sample bank ratio report: [insert banking ratio sample report]

Tax Return Numbers vs. Generally Accepted Accounted Principles (GAAP)

Bankers, prospective buyers and company management prefer to make decisions regarding the financial condition of a company using financial statements prepared according to Generally Accepted Accounting Principles (GAAP). GAAP financial statements present an accurate picture of a company’s story. Let’s look at a recent example:

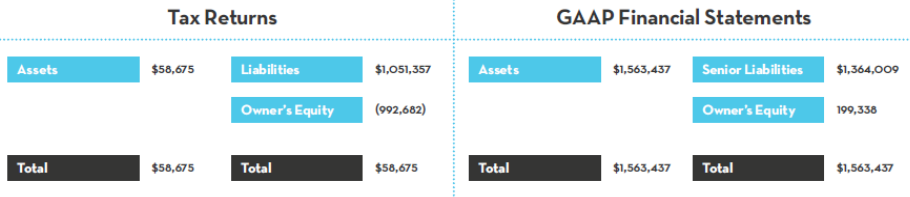

Linked Accounting assisted a company seeking to acquire more equipment which would help grow revenue and improve profit margins. Their current bank was in receipt of company tax returns filed on a cash basis and with accelerated depreciation of their fixed assets. The bank assigned their existing loans to the “Loan Workout” group due to the perceived poor financial condition of the company. Linked Accounting prepared GAAP formatted financial statements for the company. A general overview of the comparative balance sheets are provided:

Recreate this

Impact on Collateral

Lenders often consider the amount of assets on a company balance sheet to be the starting basis to determine the value of collateral a company can pledge for loan requests. In the above example, aggressive tax depreciation strategies were utilized to reduce the asset values and subsequently the available collateral significantly. The GAAP financial statements projected a much larger available amount of collateral. Companies can continue to prepare tax returns the same way they have historically. Preparing GAAP statements are in addition to not in place of tax returns.

Bank Consulting

Linked Accounting is tremendously well-positioned to help you obtain the best capital structures at the best possible rates. With over 15 years of senior banking experience, our partners offer a valuable insider’s perspective to the banking industry. Through services such as bank ratio monitoring and loan application assistance, Linked Accounting brings you access to capital when you need it the most – all at the lowest costs available.

Impact on Owner’s Equity

The amount of owner’s equity is extremely critical to lenders. Imagine a homeowner who requests a mortgage when he currently owes more to creditors on his home than his home is worth. It would be highly unlikely he would be successful securing an additional mortgage. In the above example, the company was asking for additional loans when his tax returns suggested he owed his creditors $992,682 more than his current equity in this company. The GAAP financial statements accurately reflected his equity to be nearly $200,000 in the company.

The Outcome

With GAAP financial statements, the company obtained additional lending offers at reduced rates from four different institutions when his current bank told him he didn’t qualify for any additional loans. Linked Accounting helps you obtain the best capital structures at the best rates!